💪 No guesswork, more upside.

We’ve worked 35,500+ hours tackling co-ownership, so you don’t have to.

One tool to manage home co-ownership, together.

Money matters

Plan finances, expenses, and payments.

Ownership

Define structure and individual interests.

Risks

Identify, safeguard, and specify remedies.

Admin

Streamline day-to-day tasks.

Rights & responsibilities

Align goals and expectations, flexibly.

Exit strategy

Prepare for eventual unwind or transfer.

Built to make co-owning a home easy.

Shared Homeowner OS™ puts you in control over the full ownership lifecycle.

Set your terms

Collaborate in real-time with step-by-step guidance to set the terms of your co-ownership arrangement. An intuitive workflow streamlines decision-making. Eliminate guesswork, avoid drama.

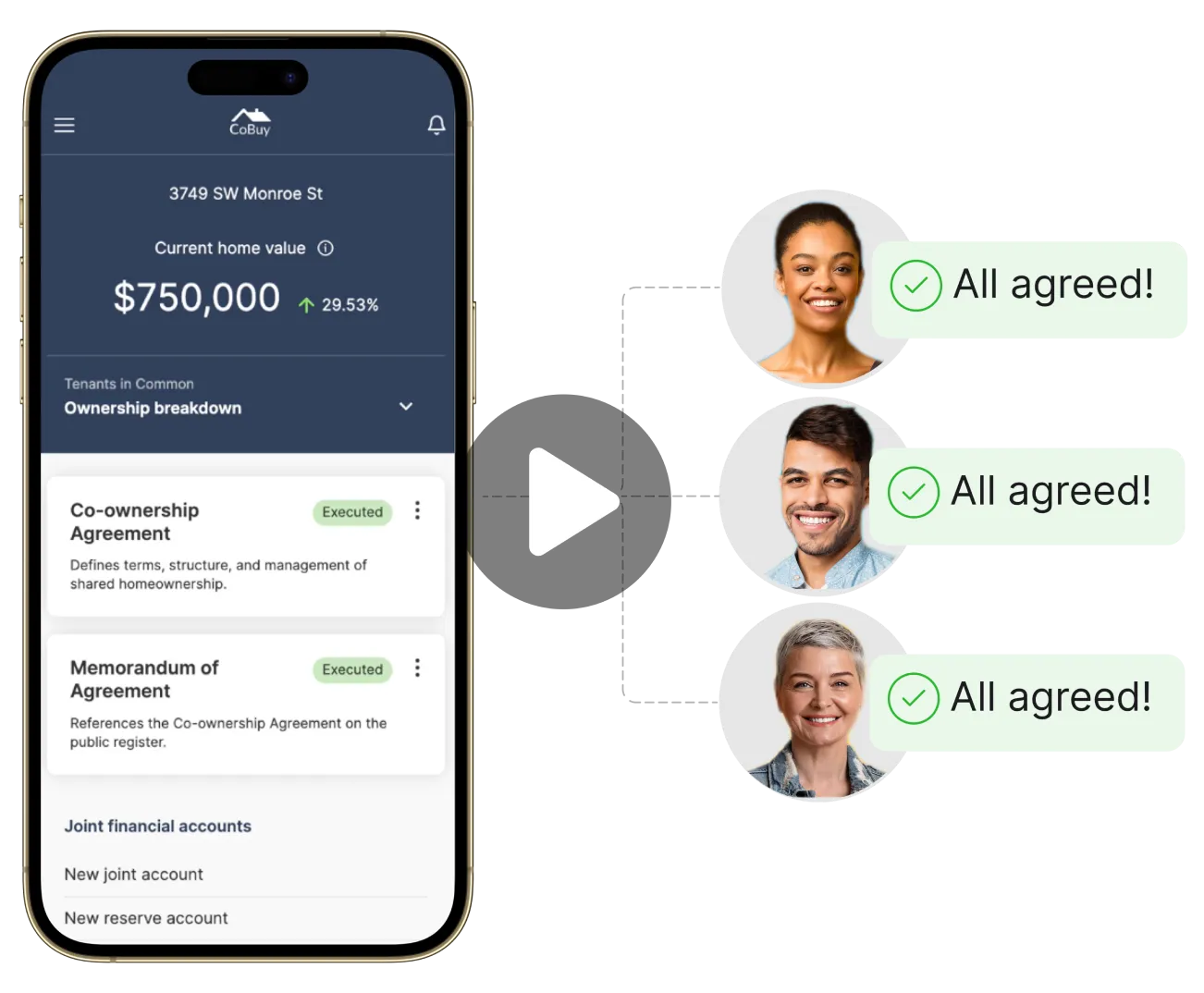

Create flexible agreements

Generate, review, and digitally sign agreements. Executed agreements are encrypted and recorded to blockchain. Need to make a change? No problem. Modify, confirm, and re-execute in a few taps.

Organize docs, records, receipts

Store all your important files in one place with easy access, sharing, and version control. Authentication by all co-owners marks files as legit. Breathe easier when tax season rolls around, or it’s time to sell.

Seriously secure.

You control your data. We go to great lengths to keep it safe and secure.

Multi-factor ID verification

Government ID cross-referenced with live imaging and personal verifiers.

Blockchain authentication

Smart contracts from the world's fastest, most secure blockchain network.

256-bit advanced encryption

Data encryption algorithms used by the United States National Security Agency.

Cover your risk, build wealth.

With Shared Homeowner OS™, manage your co-investment like a pro—and enjoy the upside.

Nobody knows co-ownership better. We've worked with thousands of co-buyers and co-owners, and been there ourselves.

Save $10k on upfront legal fees

Eliminate 120 hours of annual admin

Avoid conflicts, court, and probate

Minimize unexpected tax consequences

Plan your exit strategy

FAQs

Your questions, answered.

Co-ownership is when two or more people who are not married to one another own a home together.

Friends, family members, or couples—or any combination—can own a home together.

Co-ownership is also called shared homeownership, fractional homeownership, or joint homeownership.

Shared Homeowner OS™ is an app to help you plan, structure, and manage co-ownership together efficiently and effectively.

With Shared Homeowner OS™, you’re able to manage co-ownership like a pro:

🤝 Streamline decisions

💸 Plan finances, expenses, payments

📝 Create a Co-ownership Agreement in 45 minutes

✍️ Digitally sign from anywhere

🔐 Manage key documents

🚪 Define an exit strategy

🪄 Update anytime

Shared Homeowner OS™ puts co-owners in control over the entire lifecycle:

- Avoid guesswork and conflict

- Save $1,000s on legal fees

- Save 120 hours a year on admin

- Protect relationships, investments, and the home

Instead of winging it, you can de-risk, protect, and build wealth.

Shared Homeowner OS™ helps folks who own a home together:

- Friends

- Family members

- Unmarried couples

- Couples

- Combinations of the above

Today, we're setup to help those who:

1. Co-own a home in the U.S.

2. Co-own a home as a group of 2 to 4 total (excluding renters, kids, anyone not on Title)

We're working to expand our offering.

Shared Homeowner OS™ subscription:

$30.00 / person / month, paid annually

$22.50 / person / month, paid annually (25% off during private beta and beta)

That’s less than the cost of one cappuccino a week to protect your relationships, investment, and home.

A beta is when our app is opened up for more people to try. During this phase, we invite a larger group to use the app and tell us what they think. Your feedback helps us spot any issues and improve the app before its full release. It's a team effort to make the app the best it can be.

Join the waitlist for our beta here.

Thanks to all our private beta participants! We'll notify private beta participants and folks on the waitlist (in that order) ahead of the beta launch.

Leading industry pros agree.

"Homeownership is not one-size-fits-all. CoBuy gives you the resources to make homeownership adapt to your needs while covering all of the practical and technical bases."

Edward Ong

Principal • Broker • Attorney

Corpen Real Estate Group

“CoBuy helps folks to set up a framework for co-ownership so that things go smoothly and the individuals involved are protected. Efficient, effective, everybody wins.”

Trevor Reese

Area Manager

Revolution Mortgage

"It's important to get all parties on the same page on issues that don’t show up on loan or purchase documents. Having CoBuy to manage this can make all the difference."

Frank Sandoval

Loan Officer

U.S. Bank

✨ Get early access

Missed the Private Beta? Beta launch coming in Q2!

Direct access to our team + 1:1 support

25% discount off annual subscription

Input on new features and product development